Ira Wage Limits 2024

Ira Wage Limits 2024. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. The ira contribution limits increase to $7,000 in 2024, or $8,000 for those 50 and older.

There are no income limits for traditional iras. 2024 simple ira contribution limits.

There Are No Income Limits For Traditional Iras.

The irs provides instructions for how to calculate the amount of your reduced roth ira contribution for the 2023 tax year (these figures may change when.

Uncover Details About The 2024 Ira Contribution Limits To Plan Your Retirement Savings Efficiently.

Roth ira income and contribution limits for 2024 the maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

2024 Simple Ira Contribution Limits.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute to a roth. The maximum amount you can contribute to a traditional ira or a roth ira in 2024 will be $7,000 (or 100% of your earned income, if less), up from $6,500 in 2023.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, And for 2024, the roth ira contribution limit is $7,000 for. Next year’s limits are $500 higher than the 2023 ira limits.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

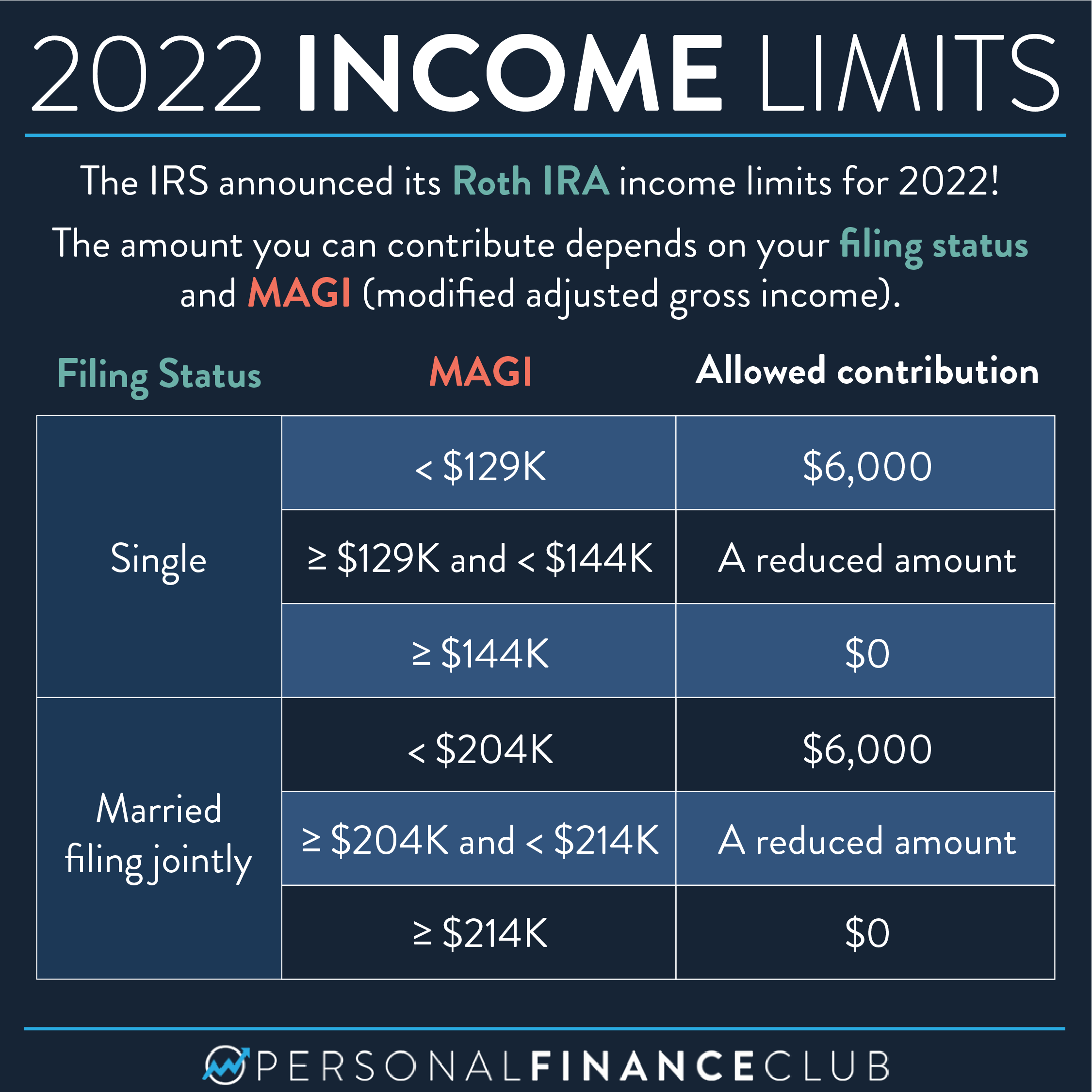

The IRS announced its Roth IRA limits for 2022 Personal, Workers age 50 or older can. For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, For 2023, the total contributions you make each year to all of your. 2024 simple ira contribution limits.

Source: clioqlulita.pages.dev

Source: clioqlulita.pages.dev

Simple Ira Contribution Limits 2024 Over Age 50 Katya Melamie, Learn how ira income limits vary based on which type of ira you have. Roth ira income and contribution limits for 2024 the maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

Source: choosegoldira.com

Source: choosegoldira.com

self directed ira contribution limits 2022 Choosing Your Gold IRA, Uncover details about the 2024 ira contribution limits to plan your retirement savings efficiently. To save $7,500 for retirement in a fully taxable account, you would have to earn about $9,868 before taxes.

Source: phyllyswrow.pages.dev

Source: phyllyswrow.pages.dev

Able Contribution Limits 2024 Jada Rhonda, The ira contribution limits increase to $7,000 in 2024, or $8,000 for those 50 and older. With a traditional ira, however, you can deduct that.

Source: charmainewannice.pages.dev

Source: charmainewannice.pages.dev

Pennie Limits 2024 Calculator Raye Valene, For 2024, you can contribute up to $7,000 in your ira or $8,000 if you’re 50 or older. The ira contribution limits increase to $7,000 in 2024, or $8,000 for those 50 and older.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, There are traditional ira contribution limits to how much you can put in. The maximum total annual contribution for all your iras (traditional and roth) combined is:

Source: www.blog.passive-income4u.com

Source: www.blog.passive-income4u.com

IRA Contribution Limits And Limits For 2023 And 2024, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

The Ira Contribution Limit Is $7,000, Or $8,000 For Individuals 50 Or Older In 2024.

To save $7,500 for retirement in a fully taxable account, you would have to earn about $9,868 before taxes.

Ira Contribution Limits For 2024 The Limit For Both Traditional And Roth Iras Is $7,000 Total From Among All Accounts, A $500 Increase From The $6,500 Limit In 2023.

Ira contribution limit increased for 2024.